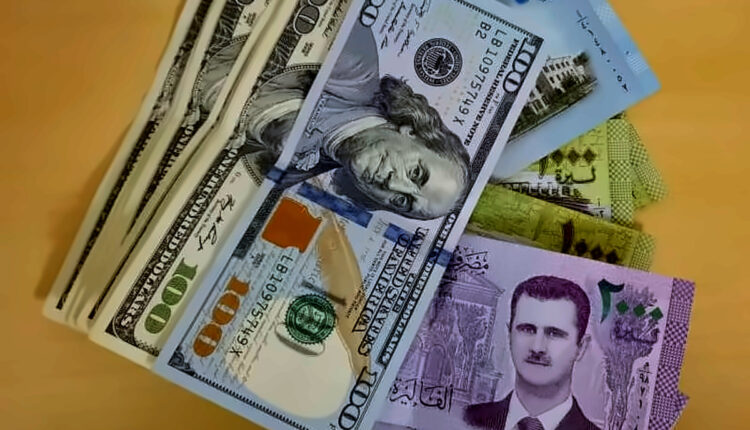

Syrian Pound Experiences Volatile Recovery Following Assad Regime Collapse

By Kardo Roj

HASAKAH, Syria (North Press) – Syria’s currency markets remain volatile as the Syrian Pound (SYP) experiences a slight recovery against foreign currencies, with the exchange rate for 1 U.S. Dollar stabilizing between 10,000 and 12,000 SYP in northeastern and central regions on Saturday.

This marks a significant improvement from last week’s dramatic devaluation, which saw the Pound plummet to as low as 40,000 SYP per Dollar in the immediate aftermath of Bashar al-Assad’s regime’s collapse.

Mixed Signs of Recovery

Local exchange shops in Hasakah reported that the SYP’s value has been fluctuating significantly over the past three days.

Abdulsalam Mohammed, a currency trader in Hasakah, told North Press:

“We recorded a buying rate of 10,000 SYP per Dollar and a selling rate of 11,000 SYP this morning. The Euro is trading at 10,300 SYP for buying and 11,300 SYP for selling.”

Despite this improvement, traders warn that the recovery lacks stability, as exchange rates continue to fluctuate daily across different regions.

In Aleppo and Damascus, the exchange rate remains slightly higher, at around 12,000 SYP per Dollar.

Factors Behind the Volatility

The Syrian Pound’s recent collapse was triggered by political and economic uncertainty following the fall of Assad’s regime. The sudden power shift disrupted financial markets, fueling panic among citizens and investors alike.

Currency traders in Hasakah attribute the recent recovery to:

- Local Efforts to Stabilize the Market: The introduction of temporary measures by local authorities and economic councils in northern Syria.

- Increased Demand for Local Currency: A surge in remittances from Syrians abroad has temporarily boosted the SYP’s value.

- External Assistance: Neighboring countries and international organizations are reportedly exploring ways to prevent further economic deterioration.

However, experts caution that without a unified financial strategy, the fluctuations are likely to persist.

Economic Challenges Ahead

The Syrian economy, already battered by 13 years of conflict, faces immense challenges. The collapse of the Assad regime and ongoing political uncertainty have left many institutions in disarray.

Food and fuel prices remain high, putting additional pressure on ordinary Syrians. Many merchants now insist on conducting transactions in U.S. Dollars or Euros to protect against further devaluation of the SYP.

Impact on Syrian Households

The fluctuating currency rates are exacerbating existing hardships for millions of Syrians. Many have seen their purchasing power erode as salaries and savings in local currency lose value.

In Hasakah, residents have expressed cautious optimism. Ahmed Saleh, a small business owner, told North Press:

“If the Pound stabilizes at these rates, it could help us resume normal trade. But we’re still wary—one sudden change, and it all collapses again.”

Outlook

The Syrian Pound’s future depends largely on the political stability of the transitional authorities and their ability to rebuild economic institutions. While temporary improvements bring hope, long-term recovery will require a coordinated effort involving regional and international stakeholders.